Let’s face it; the once sacred cows (job security, pension, retirement security and so on) that gave milk are now obsolete. Not saying that employment is a bad thing. Just that it’s a limited way of generating income if it’s your only source. This article is inspired by the book, The Business of The 21st Century by Robert Kiyosaki. Because most of us are brainwashed by our circumstances to think of employment as normal, I’ll highlight some keys lessons from the book you can utilize to take charge of your finances.

- Make More Money – Someone who earns $876k a year has a higher financial intelligence than someone earning $40k a year. You can definitely make more money by learning how to build and control an infrastructure. There has never been a better time to own your own business than today, right now. These are times pregnant with economic potential. “All people are entrepreneurs” – Yunus. That means your entrepreneurial spirit has to kick in especially if you’re comfortable at your job because when the economy slows down, you can’t depend on employers. You have to breakout out of your comfort zone and start to look for other ways to generate income. Before you grow your business, you have to grow yourself. You do this by learning how to sell yourself, products and ideas. Some of the highest earners in the world are people who know how to sell.

- Protect Your Money – Besides the parasitical money managers that siphon your funds with fees regardless of performance, the government is another financial predator who takes your money legally. This means you have to learn strategies to take advantage of the tax loopholes. For example, John and Doe both make $500k a year. Doe pays 15 percent in taxes or none at all while John pays 35-40 percent. This means Doe has a higher financial IQ.

- Budget Your Money – Many people come up short when it comes to keeping the money they do earn because they have poor management skills. Being able to live well and still invest no matter how much or little you make requires discipline. Having a surplus is something you have to actively shoot for.

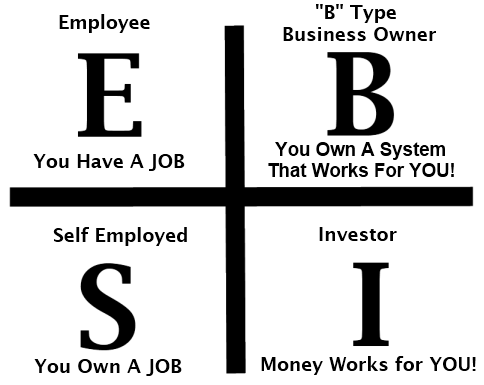

- Leverage Your Money – ROI (Return on investment) is another measurement of financial intelligence. John could be smarter academically and have better grades than Doe. And yet, Doe can have a higher financial IQ. Instead of changing jobs, the solution is to change the quadrant from which you earn. If you’re familiar with Robert Kiyosaki’s cash flow quadrant, the left side is where most people (80 percent of the population) live.

You were thought by your parents and the school system that you’ll find security and safety in the left side by going to school and getting good grades. The truth is the right side is where real freedom exits.

You were thought by your parents and the school system that you’ll find security and safety in the left side by going to school and getting good grades. The truth is the right side is where real freedom exits.

If you like this article, share, leave comments, click the like button and subscribe to get weekly updates and tips.

Great articles brother

Thanks!